Onboarding Guide

Final DD & Account Setup

Step 1:

Step 2:

Step 3:

Step 4:

Step 5:

Step 6:

Upload the checklist of items below to the Data Room

Upload contracts to Trade Documents - instructions below

Answer any follow up questions from our credit team

Connect bank account(s) - instructions below

Review and execute legal documentation

Schedule a Dashboard Demo

Data Room Checklist 2

A scanned copy of the passports of all company Directors.

Please upload:

Please submit a scanned copy of the first two pages of the passport of each company Director as a high-resolution pdf file in colour.

Why do we need this?

This is a basic KYC requirement that we must comply to as a lending business.

Your company's memorandum and articles/bylaws (US)

Please upload:

Please submit a copy of your company's memorandum and articles/bylaws (US) in PDF format.

Why do we need this?

We ask for this so we can check that there are no clauses in your company's constitutional documents that might impede us working together.

Your company's registration/incorporation certificate.

Please upload:

Please submit a copy of your company's certificate of incorporation/registration in PDF format.

Why do we need this?

This forms part of our KYC (Know Your Customer) check. As a money lending business, by law we are required to run basic checks on all incoming customers relating to the company's formation, its management and its shareholders.

Bank statements from the last 6 months.

Please upload:

Please provide the last 6 months bank statements, exported from your online banking facility in PDF (no scans please) and Excel format.

Why do we need this?

We ask for this so we can validate your current and historical liquidity position and the payment behaviour of your debtors.

Business Plan/Budget for the current year.

Please upload:

Please upload your Business Plan/Budget for the current year. Excel format is preferred.

Why do we need this?

We ask for this so we can understand your company's forecasted growth trajectory and future revenue development.

A 12 month forecast of your liquidity

Please upload a monthly cash flow forecast for the next 12 months. Excel format is preferred. We can provide you with a template CF forecast for guidance, please just let us know.

Why do we need this?

We would like to ensure that we understand your future working capital and cash needs over the next 12 months.

Please provide copies of the contracts of existing debt facilities.

Please upload:

Ideally the finance agreement and security agreement (if applicable).

Why do we need this?

We need this to get a better understanding of the terms of the existing debt facilities and also to see if there are any restrictions on granting new loans / security over your assets.

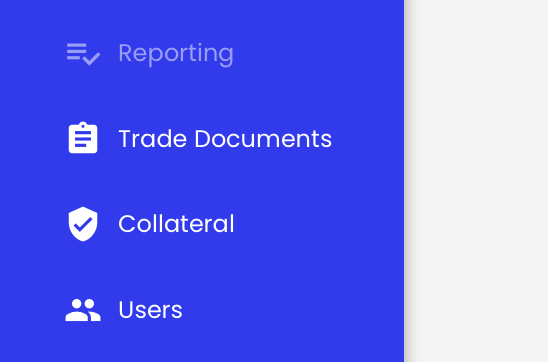

Upload Trade Documents

1. Go to 'Trade Documents' in the left side menu of the Dashboard

2. Upload the requested customer (debtor) contracts / terms & conditions / insertion orders

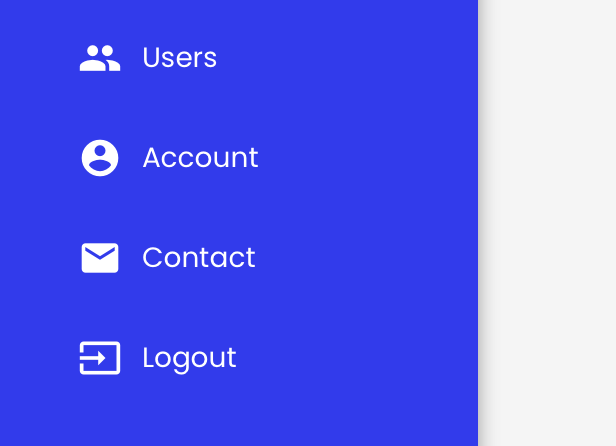

Connect Bank Account(s)

1. Go to 'Account' in the left side menu of the Dashboard:

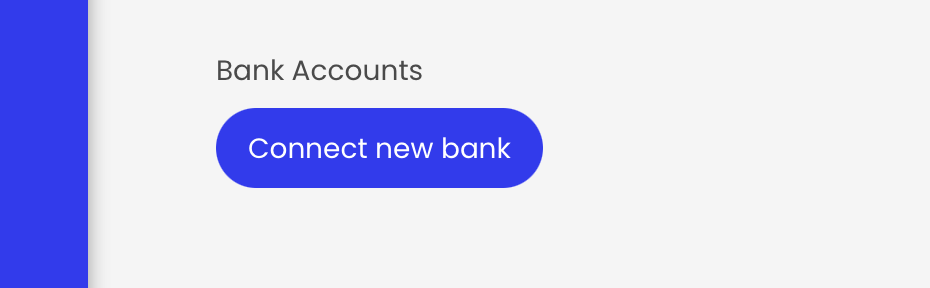

2. Under 'Bank Accounts ' select 'Connect new bank':

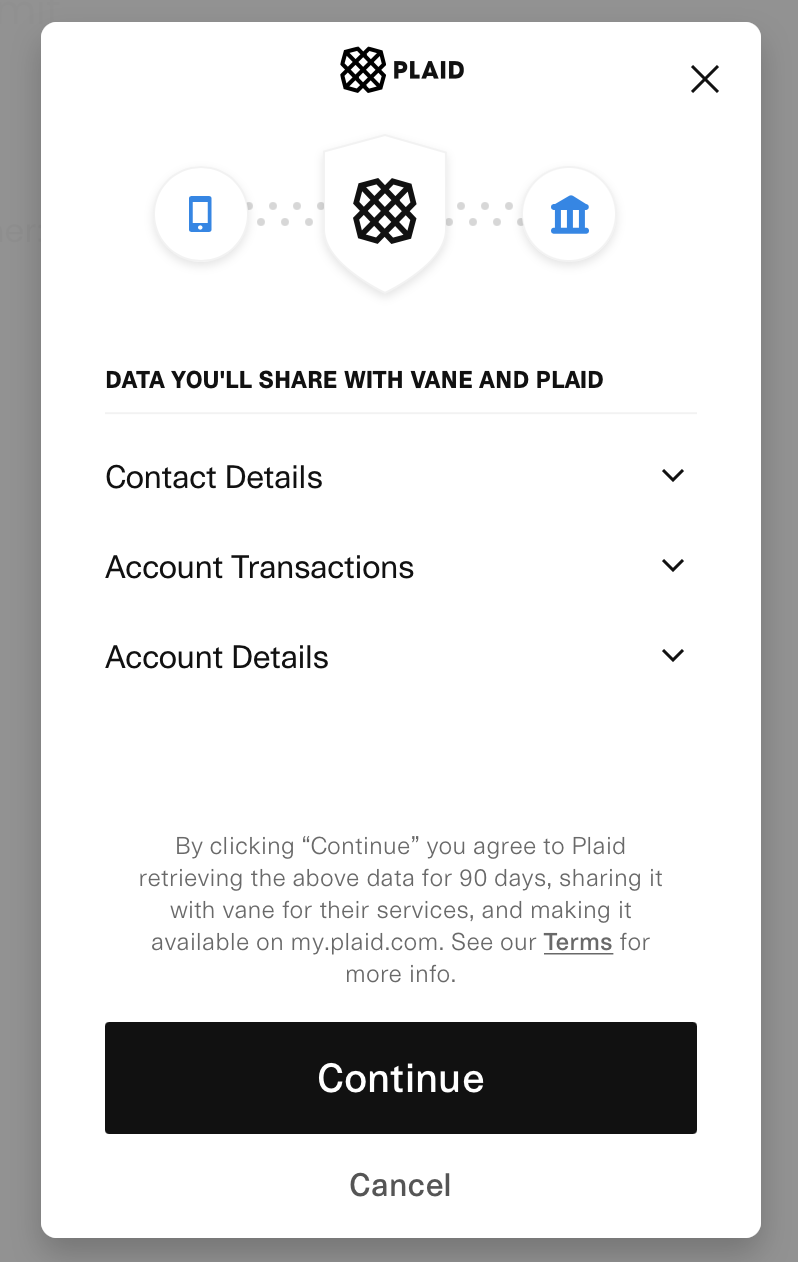

3. Follow the Plaid instructions:

Get in touch to learn more about our services and how we can boost your business.

We promise to get back to you within 48 hours.

Site Map

Legal & Privacy

Get Connected

'Vane' and 'Vane Financial' are trading styles. Vane Finance Technology Limited is a company registered in England and Wales (Company No: 9446187) and is registered in the UK with the Financial Conduct Authority reference 09446187. Vane Finance Technology Inc. is registered in the State of Delaware and operates under a California Financing Law license. Our Headquarters is Vane GmbH (HBR 162057 B), registered in Berlin, Germany.

Copyright © 2021 Vane (Group). All Rights Reserved.