Facility FAQs

Frequently Asked Questions

Vane provides Revolving Credit Facilities which are backed by your Account Receivables. The facility enables you to draw down single or multiple Advances, with the option to “roll” (i.e. keep the Advance and do not repay the Advance) at each Maturity date.

The total current drawn amount together with new Drawdown or Rollover request cannot exceed the agreed Credit Limit (as per the latest facility agreement signed). Moreover, the total amount available to draw can be limited by the Minimum Collateralisation Ratio which was agreed contractually.

Example: If your minimum Collateralisation Ratio is 125% and you have a Credit Limit of $1,000,000, your eligible receivables collateral must be at least 125% of your total outstanding loan balance. E.g., if your eligible receivables collateral is $1,250,000, you can borrow up to $1,000,000 of, but not exceeding, your Credit Limit of $1,000,000. If your eligible receivables collateral is $1,500,000, you can draw up to $1,000,000 as the Credit Limit is at $1,000,000. If your eligible receivables collateral is $1,000,000, you can draw up to $800,000 as the Minimum Collateralisation of 125% is to be complied with.

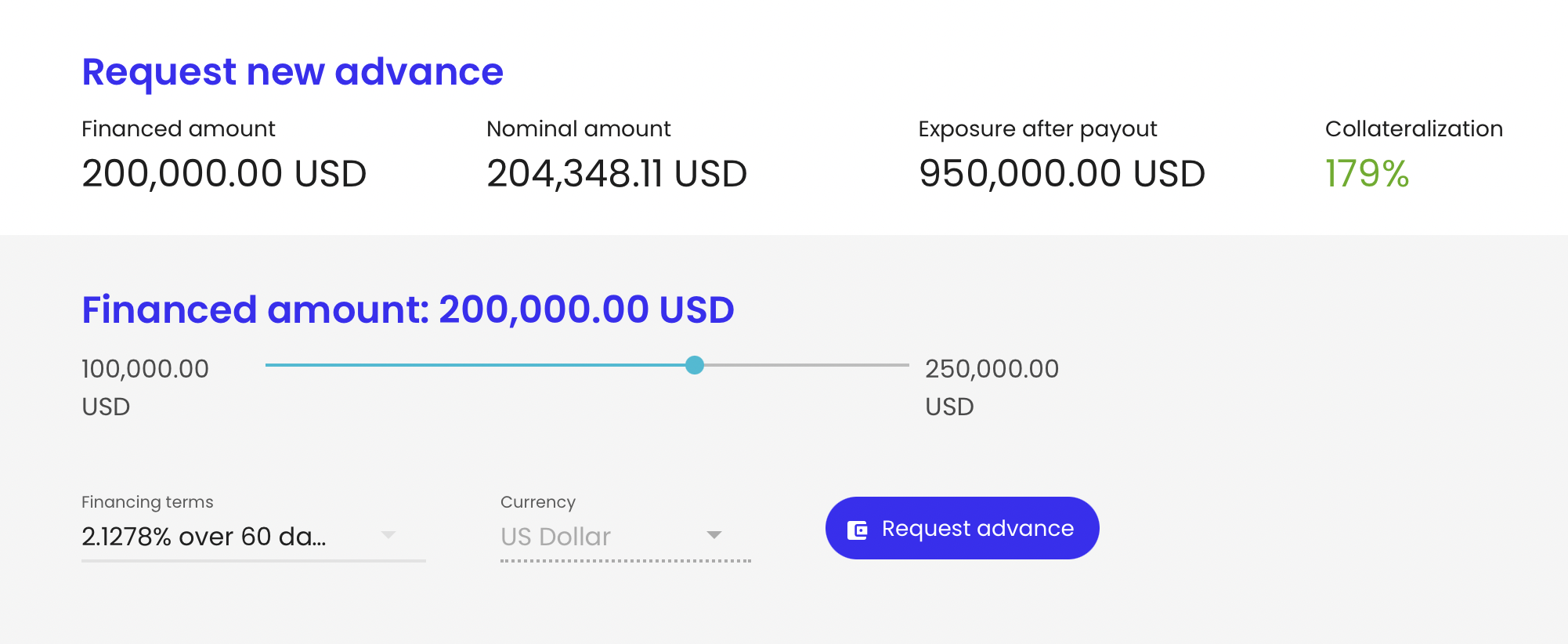

Drawdowns can be requested via the Dashboard. For pay out on Friday, drawdowns should be requested no later than Monday of the same week. The Dashboard also allows you to select the required drawdown amount (e.g. $200,000 in illustration above) and Maturity (e.g. 60 days) for a new Advance or a Rollover Advance (subject to agreed terms). Following invoice validation (see section below) which is done on Tuesday, and payment of Facility Fee (for non-Legacy Customers only - see section below), funds will be advanced to your bank account on Friday of the same week. Typically, there is a minimum drawdown amount (e.g. 100,000 of the respective currency).

At Maturity of an advance, you either:

- Pay back 100% of the Advance

- Roll-over the Advance, or

- Request a decrease or increase in the respectable Loan Amount (subject to a minimum size of the rolled amount)

Unless an increase has been requested, there will be no pay out of “new money”. The funds you have been using earlier can be continuously used for until the next (new) rollover date (subject to contractually agreed terms met).

The interest payable on each Loan Advance is payable prior to the payout of each Loan Advance (we pay out, or roll, 100% of Advance amounts, less the interest).

Example: if you request an Advance of $1,000,000 and your interest is 2.0% for 60 days, we will transfer $980,000 into your account. On the maturity date of the Advance (60 days later), you will repay the full $980,000.

For Rollovers, you would be required to pay only the interest of $20,000 at maturity of the Advance, with the $980,000 Advance continuing to a new maturity date (assuming the Rollover amount does not change).

The interest payable on each Loan Advance is payable on the maturity of each Loan Advance (we pay out, or roll, 100% of Advance amounts).

Example: If you request an Advance of $1,000,000 and your interest is 2.0% for 60 days, we will transfer $1,000,000 into your account. On the maturity date of the Advance (60 days later), you will repay the full $1,020,000.

For Rollovers, you would be required to pay only the interest of $20,000 at maturity of the Advance, with the $1,000,000 Advance continuing to a new maturity date (assuming the Rollover amount does not change).

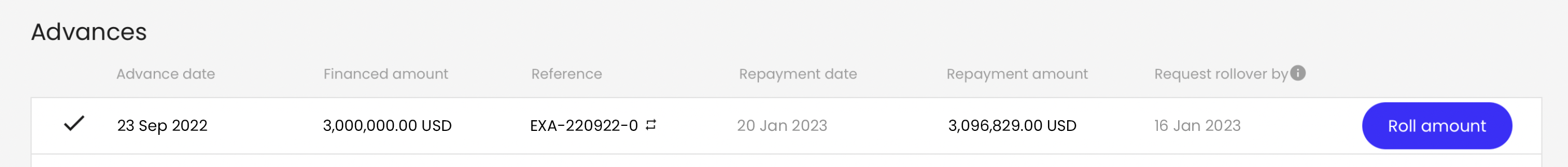

You will receive an email notification at least two weeks prior to the Maturity of an Advance. Depending on the day of the week that the Maturity date falls on, you will need to request a rollover up to 11 days prior to the Maturity date.

If Maturity falls on a Friday: the Rollover Request Deadline is Monday of the week of the Maturity.

Example: Maturity on Friday 14th August; request by Monday 10th August.

If Maturity falls on any other day of the week: the Rollover Request Deadline is Monday the week prior to Maturity.

Example: Maturity on Tuesday 14th August; request by Monday 6th August.

Campaign validations should be uploaded right after you have requested a new Advance and/or a Rollover Advance.

- Please log onto the Vane Dashboard

- Under the Tab called Collateral, you will see a selection of randomly selected invoices for which we ask you to upload the respective validations

You can use the upload button to upload the respective validations. If there is any discrepancy to the amount shown in the Dashboard, please provide some explanation in the free text field so we can understand the mismatch.

In cases where Vane has access to your campaign dashboard, Vane will take care of the upload and finalization with nothing else to be done from your side.

Typically, there are two scenarios when you are unable to rollover an advance or the full amount of an advance:

Insufficient invoices of qualifying debtors to finance

In this case, Vane will review:

- Additional debtors in your Portfolio which have not been qualified yet and fulfill the criteria of a qualifying debtor, and/or

- Existing credit limits of qualifying debtors

Once new limits have been approved internally, we will update the Schedule 1 of your Facility Agreement which lists all Qualifying Debtors, accordingly, send it out to you for signature and you should then be able to roll the total financed amount.

Please note that all Qualifying Debtors are listed under Account in the Vane Dashboard. If you would like to see the respective qualifying debtor limits, please refer to the latest Schedule 1.

Insufficient collateral

This can be a result of too few invoices having been issued, several invoices having been paid or invoices that are too old and hence exceed the maximum collateral days age. In this case you should:

- Issue further invoices against debtors which are part of the collateral (depending on the underlying law of the contract), and/or

- Provide some IO’s/underlying Contracts by uploading these onto the Vane Dashboard under the respective Debtor name which can be found under Reporting in the Vane Dashboard so Vane can assess the underlying governing law

- Please note that you can see the Collateral in the Vane Dashboard under Collateral (this is where the invoice validation is being submitted)

Other Reasons why you can’t roll over an advance

- Breach of other covenants: Subject to further analysis, covenant breaches as per the signed Facility agreement can trigger a repayment. In these cases, Vane will analyze the respective breach and decide on a reasonable basis whether to grant a rollover or not. The analysis is usually accompanied by further discussions and additional information provided by the client

- Insufficient liquidity: If Vane deems the cash runway to be too short or the overall cash balance of a client to be too low and/or below the minimum agreed cash balance (as per agreement), Vane can request a repayment of the advance and/or deny rollover of such an outstanding advance. In these cases Vane will ask for further information and seek discussions with the client to better understand the situation to make a reasonable decision

- Fees outstanding: Vane may not allow a rollover/payout in case of any pending fees. These can be roll over related or any other fees that still need to be paid

Each Advance shall not be repaid later than the relevant repayment date. The repayment occurs once we have received the funds in the respective collection account.

Example: If an advance matures on 14th August, repayment must be done prior to that day, so that the funds arrive in the respective account no later than 14th August.

Please always transfer interest payments and repayments of Advances to the Collection account with the Account Holder being Vane Finance Technology Limited. You can find the bank account details in the most recent version of the Facility Agreement, typically in Schedule 5 (Part A). Please contact us if you are unsure which account you should transfer the money into, and we will advise accordingly.

This account shall only be used for:

- Any Fee payment (but never repayments and/or interest payments), i.e. Legal Fees, Non-Utilization Fees, Arrangement Fees, Set-up Fees, Dashboard Access Fee

- You can find the bank account details in the most recent version of the Facility Agreement, typically in Schedule 5

- If you are unsure about which bank account to use, please get in touch with us and we are happy to provide you with the correct information/instructions

As contractually agreed, Vane can charge you late fees for every day the repayment is still pending and has not reached our account. The late fee is determined in the facility agreement and is based on the amount outstanding.

Example: if you decide on repaying a $300,000 advance with maturity of 14th August, the $300,00 need to arrive in the Collection account no later than 14th August. For every Day, the $300,000 have not arrived in the Collection/Transaction account, Vane is entitled to charge you late fees.

Interest payments always relate to the initial requested advance amount/Rollover amount of an advance and are fixed until the maturity date.

This means even if you repay i.e. $200,000 after 50 days of an advance with an initial size of $1,200,000 with financing terms of 90 days and payable interest of $40,000, you would still have to pay the full $40,000 in interest at maturity date of the Advance.

Get in touch to learn more about our services and how we can boost your business.

We promise to get back to you within 48 hours.

Site Map

Legal & Privacy

Get Connected

'Vane' and 'Vane Financial' are trading styles. Vane Finance Technology Limited is a company registered in England and Wales (Company No: 9446187) and is registered in the UK with the Financial Conduct Authority reference 09446187. Vane Finance Technology Inc. is registered in the State of Delaware and operates under a California Financing Law license. Our Headquarters is Vane GmbH (HBR 162057 B), registered in Berlin, Germany.

Copyright © 2021 Vane (Group). All Rights Reserved.